Meta is under pressure and here’s why– in October, the company took down over 8000, “celeb bait” ads from Facebook and Instagram. These ads used images of famous Australians such as David Koch, Anthony Albanese, Gina Reinhart, and Robert Irwin in “deepfake” videos to trick consumers into contributing large sums of money into fake investment opportunities.

While thousands of accounts have been taken down, the scams are still proliferating. In lieu of this, Meta has announced new “tightened” ad rules for financial services advertisers.

How do the fake celebrity scams work?

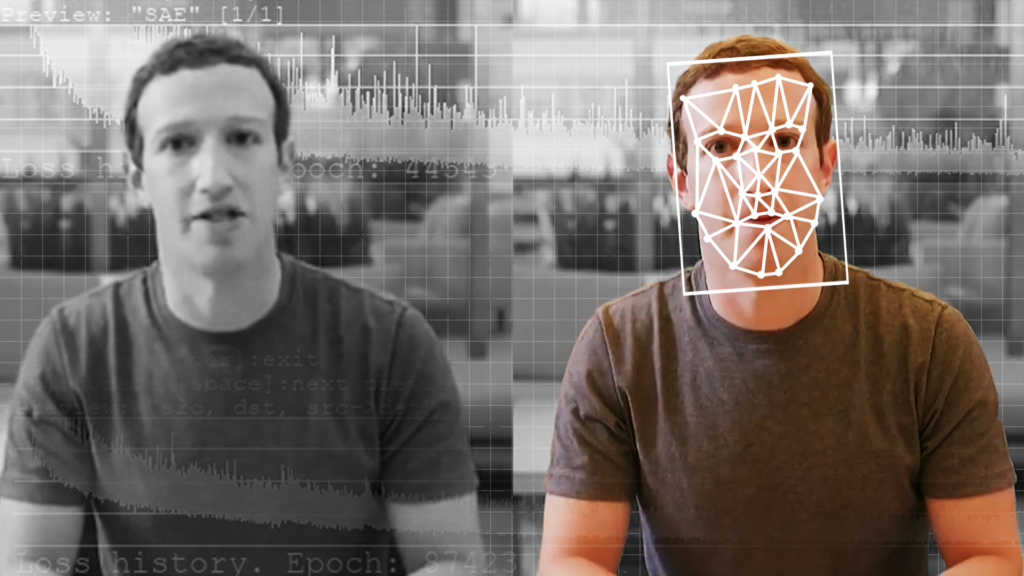

First, let’s establish what a deepfake is. According to Merriam-Webster dictionary, a deepfake is an image, video, or audio recording that has been edited using an algorithm to replace the person in the original with someone else, typically a public figure.

Deepfakes are made to look as authentic as possible to convince unsuspecting individuals about something that isn’t real or true.

Financial scammers create deepfakes to get individuals to invest in fake platforms. For instance, a victim may be asked to sign up for something that seems real, thus giving away all their personal details. The scams usually create a sense of urgency amongst individuals, convincing them of the highly time-sensitive nature and return rates of the fake opportunity.

According to Yahoo, former Sunrise host David Koch has had his image misappropriated by scammers on social media sites. The ads typically link to a fake media article that include images of Koch or quotes endorsing cryptocurrency schemes.

What is Meta doing about such scams?

New financial ad regulations are set to roll out by February next year. In the mean time, Meta is identifying a range of financial products and services that will require extra verification across all its platforms. Once verified, financial advertisers will need to include both payer and beneficiary information in their ads.

This means users will now be privy to information about who is behind the ad. Additionally, verified ads will also remain available for users to view within the Meta Ad Library as long as it’s active.

According to the National Anti-Scam Centre, over $35 million has been lost to social media scams between January to September of this year. Meta is also facing a string of lawsuits from public figures as well as the Australian Competition and Consumer Commission.

Moreover, in partnership with the Australian Financial Crimes Exchange (AFCX), Meta is set to introduce anti-scam measures which include facial recognition testing to mitigate celeb-bait scams.